European Social Fund Plus

General information

Previous name: European Social Fund

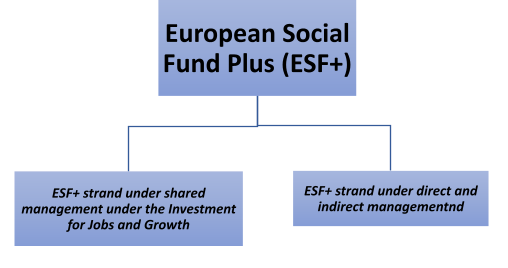

Organigram

Introduction

The ESF is Europe’s main instrument for supporting Jobs; helping people get better jobs and ensuring fairer job opportunities for all EU citizens. It works by investing in Europe’s human capital – its workers, its young people and all those seeking a job. The ESF has legal basis in the Treaty as one of the EU Structural Funds aiming to strengthen the EU’s economic, social and territorial cohesion and reduce disparities between regions. Its goal is to “improve work opportunities and contribute to raising the standard of living”.

For 60 years now, the ESF has been promoting employment, improving skills and fostering social inclusion. It is estimated that the Fund helps 10 million people every year to get (back) into work, improve their skills or get out of poverty and social exclusion to fully participate in society. The ESF funded tens of thousands of local, regional and national employment-related projects throughout Europe: from small projects run by neighbourhood charities to help local people find suitable work, to nationwide projects that promote vocational training among the whole population. There are projects aimed at education systems, teachers and schoolchildren; at young and older job-seekers; and at potential entrepreneurs from all backgrounds.

Creating more and better jobs and a socially inclusive society are the goals at the core of the Europe 2020 strategy for generating smart, sustainable and inclusive growth in the EU. The ESF is playing an important role in mitigating the consequences of the economic crisis – the rise in unemployment and poverty levels. Priorities are to boost the adaptability of workers with new skills, and enterprises with new ways of working; to improve the access to employment by helping young people make the transition from school to work, or training less-skilled job-seekers to improve their job prospects; and to help disadvantaged groups to get jobs. This is part of enhancing ‘social inclusion’, helping people integrate better into society and everyday life.

The ESF+ is the new simpler (in terms of reducing administrative burden on national authorities or organisations benefiting from ESF+ measures) but stronger version of the ESF.

It is the result of a merging of the ESF, the Youth Employment Initiative (YEI), the Fund for Aid to the Most Deprived (FEAD) and the EU Programme for Employment and Social Innovation (EaSI).

It will be a key financial instrument to implement the European Pillar of Social Rights (EPSR – the 20 principles that will guide the actions under ESF+), within the 3 main fields:

- equal opportunities and equal access to the labour market

- fair work conditions

- social protection and inclusion.

It will support Member States to invest in reforms in line with the country-specific recommendations (CSRs) and employment guidelines. Under the political agreement, the ESF + will:

- Invest in young people, who have been particularly hard hit by the socio-economic crisis following the coronavirus outbreak. Especially Member States which are above the EU average rate of young people not in employment, education or training (the “NEETs”, aged between 15-29 years) should devote at least 12.5% of their ESF + resources to help young people find a qualification, or a good quality job.

- Support the most vulnerable suffering from job losses and income reductions: at least 25% of the ESF+ resources devote to promote social inclusion.

- Provide food and basic material assistance to the most deprived, by integrating in the ESF+ the current FEAD: at least 3% of the ESF+ resources.

- Invest in children who have suffered the effects of the crisis. Especially Member States with a level of child poverty above the EU average should use at least 5% of the ESF + resources to address this issue.

- Directly support social innovation, social entrepreneurship and cross border labour mobility, through the new EaSI strand.

Specific objectives under the proposed common provisions regulation policy:

- education & training systems

- better access to employment

- modernise labour market systems

- better work-life balance, access to childcare, active healthy ageing

- lifelong learning, up- and re-skilling

- active inclusion, equal opportunities

- integration of migrants and Roma

- equal access to affordable services

- access to quality and inclusive education and training

- social integration of people at risk

- food and material assistance

Some topics are not new but are more prominent than before: social economy, skills forecasting, digital skills, early childhood education and care.

To help repair the economic and social damage brought by the coronavirus pandemic, the EC proposed on 26 May 2020 a major recovery plan for Europe based on harnessing the full potential of the EU budget, amending the original ESF + proposal. The ESF+ will support Member States in tackling the crisis caused by the coronavirus pandemic, and achieving high employment levels, fair social protection and a skilled and resilient workforce ready for the transition to a green and digital economy.

Focus of funding for 2021-2027

- education

- employment

- social inclusion & care

Thematic Priorities

- Employment, Social Affairs and Inclusion

- Education

- Youth

Participating countries

- EU27

Possible applicants

- NGOs

- Local and Regional authorities

- Research Institutes

- Public Bodies

- Social Partners

- Private Companies

Target group / Final beneficiaries

- SMEs

- NGOs

- Universities

- Students

- Civil society

Specific characteristics:

- Education systems, teachers, students and schoolchildren;

- adult education staff;

- young and older job-seekers;

- potential entrepreneurs from all backgrounds;

- persons with disabilities;

- migrants;

- socially excluded and vulnerable groups;

- Roma;

- minorities;

- elderly persons;

- less employable persons;

- children and youth;

- social partners and civil society organisations.

Budget

Total Budget for 2014-2020

EUR 84,6 billion

Total Budget for 2021-2027

EUR 88 billion (in 2018 prices)

Increase / Decrease in %

increase of 3,86%

Budget per project

Average

EUR 500.000

Min.

EUR 100.000

Max.

EUR 1.000.000 (more often € 650.000)

Complexity of budget from 1 (easy) to 5 (difficult): 5

Criteria for the complexity of budget (How detailed is the budget, how complex is the documentation, availibility of documentation, etc.)

The budget, i.e. the Financial Annex submitted with the Full Application for an ESF project is usually rather complex and detailed. When creating a budget to submit with an application, an applicant needs to divide all costs between direct and indirect costs. The minimum information an applicant needs to provide for the project budget is Total Project Costs, Total Project Yearly Breakdown, Yearly Breakdown For Each Delivery Partner (if there are any) and Staff Costs Master List (with the hourly rate information where applicable). Both match funding and ESF should be included in the budget. At Project level, the yearly total and project total figures for ESF Direct Staff Costs, ESF Other Direct Costs (if applicable) and Flat Rate Indirect Costs (if applicable) should match the same figures in the Financial Annex submitted with the Full Application. The Financial Annex is detailed presentation of the Total Project Costs broken into separate budget headings and budget lines for each budget item. Direct costs are the costs directly related to the running of the project. A beneficiary will have to provide evidence for all of these items if he/she wishes to claim back the money. This will include:

- Staff salaries for the hours directly spent on the project

- Recruitment costs

- Staff training

- Staff/volunteer expenses

- Participant costs/incentives

- Room/venue hire

- Training delivery costs

- Marketing and promotion

- Communications materials

- Equipment purchase

- Equipment hire

Indirect costs are the costs that cover the overheads and office costs that cannot be directly related to the ESF+ project. The total amount of money to be spent on indirect costs will usually be 15% of the direct staff costs and will form part of the total project costs. A beneficiary doesn’t need to provide evidence for items that are included in indirect costs. These items include costs such as:

- Copier

- Printing

- Stationary

- Office rent (unless solely used for ESF related activity)

- Utilities

- Telephone

- Insurance

- Central staff costs (HR/management)

- IT Support

All ESF+ funded programmes will need to use the Simplified Cost Option (SCO) when working out their direct and indirect costs. When using the SCO one must use either the 15% Flat Rate Indirect Costs or the 40% Flat Rate Indirect Costs. Both options cannot be used in one budget. If using the 15% Flat Rate Indirect Costs, the applicant must ensure to include all applicable costs in Other Direct Costs in addition to Staff Costs. If using the 40% Flat Rate Indirect Costs, the applicant must ensure that the only other costs in the granular budget are Staff Costs. This method is useful if most of the project expenditure is staffing costs and there are not many other direct project costs associated with the project. It will allow a beneficiary to cover more of the indirect costs than the 15% option, but he/she will have limited funds to cover other direct project costs. Where staff roles are to be recruited in future, estimated costs must be realistic and aligned with the relevant Job Description/Recruitment Advert. The job roles must match those within the project organogram. Volunteer Staff Costs must be calculated as per the wage rates set out in the ESF Eligibility Rules. If an individual will be working 100% of their working time on the project, the applicant claims for their whole salary and add on costs. If an individual works part of their working time on the project, the applicant will need to use the hourly rate calculator to work out the amount that can be claimed for their time on the project. In that case, the staff will also need to produce detailed timesheets of what hours they have spent on the project and what activities they were completing. Staff Costs for individuals working part of their time on the project must be calculated using the 1720 hourly rate calculation set out in the ESF Programme Guidance and ESF National Eligibility Rules, i.e. the hourly rate is calculated by dividing the gross pay of an individual’s salary by 1720. When entering information in the All Project Staff Costs List the staff cost methodology must also be entered. If using the “Other” selection at any point in the Granular Budget, it’s necessary to provide a narrative explanation in the Full Application as to what these ‘other’ costs are and why the applicant considers these to be eligible under the ESF Eligibility Rules. The costs in individual years should equal the total budget overview and the financial annex (if applicable). If descriptors are required for costs, the applicant uses the blank cells under the different costs the descriptor is related to.

Tips for applicants on budgeting

- Provide clear information on how you have arrived at the overall and component elements of the costs, e.g. travel costs. Be as realistic as possible about the real expenditures. Conduct a preliminary market research during the application phase and collect preliminary offers that will be needed during the full application submission and/or budget clearing once the project proposal is accepted. That way the project implementation and public procurement, which is quite complex in terms of administration needed, will also be easier.

- Provide sufficient rationale for delivery model and unit cost assumptions. It is not sufficient to simply reply on the call to provide the unit cost; there must be a clear statement on how the cost has been produced.

- Be as realistic as possible about when expenditure will occur and be defrayed– ESF operates on the basis of defrayed expenditure i.e. when a payment leaves the projects bank account, not when an invoice or cheque has been written/sent.

- The submitted Financial Annexe must not have cost headings which are not relevant to the project. All projects should use only the following headings – ESF Direct Staff Costs, ESF Other Direct Costs and ESF Flat Rate Intervention Cost.

- ‘Flat’ financial profiles are usually unrealistic – this type of approach risks leading to further questioning from the Appraiser about the effort, realism and research you have put into your financial planning for your project.

- When selecting either the 15% or 40% FRIC option, be sure to use the correct calculation to produce the relevant cost.

- When elaborating the budget, include the cost of implementing activities that contribute to horizontal priorities such as gender equality, equal opportunities, sustainable development, etc. (material adjustments, sign language interpreter, etc.). If these activities have been stated in the description of the horizontal themes, but their costs are not included in the budget, the intermediate body may request that the mentioned costs be covered from your own resources.

Programme-Specific Tips for Applicants

2-3 lessons learnt in 2014-2020

- Lower administrative burdens and simplification of processes, also in order to reduce payment delays, are strongly advocated to support access and participation in ESF+ interventions in the next programming period.

- A need for improved capacity building at national and local level addressing both programme managing bodies and beneficiaries with training measures, technical assistance, and exchange of experience in targeted meetings and workshops, as experienced in the ESF Thematic Network on Simplification has been recognised. Also, capacity building for management authorities, auditors and beneficiaries for new social inclusion and poverty reduction interventions is needed.

- A need to speed up the implementation and to further strengthen it, also providing additional assistance to beneficiaries in all the stages of the project life cycle.

Programme Specific Practical Information

- Bear in mind to build a professional consortium of relevant partners with capacities for project implementation, and to sign an internal partnership agreement with clearly defined tasks for each partner organisation.

- In depth information should be provided to show how the project meets the key requirements of the Operational Programme and the Call Specification, including a rationale on how the applicant has benchmarked deliverables.

- Sufficient description of the Delivery Model approach, including how it has been tested and/or whether it has been successfully used before should be provided.

- It is very important to present medium to long term benefits of the project.

- In depth information is required in relation to the applicants risk process, including the level of responsibility, and ensuring all risks have been considered (e.g. GDPR).

- Consistency in the use of the ESF logo and strapline in presented material need to be described, and additionally, narrative response to how the applicant will meet at least the minimum publicity requirements.

- Be sure to supply enough quality information to meet the minimum requirements for Cross Cutting Themes (horizontal issues) already at the Outline Stage.

- When submitting the Full Application, ensure sufficient response to conditions set at the Outline stage and provide information regarding the changes that have taken place since the Outline application.

- When submitting the Full Application, be sure to provide all the necessary financial documents to enable the Managing Authority to undertake the Due Diligence checks.

- Ensure consistency between the data contained in the application narrative and both the Indicator and Financial Annexes, as well as between the three tabs within the financial annexe – Cost Profile, Funding Profile and Funding Sources.

- Be sure to provide sufficient information on the procurement process to be used and how it will meet ESF requirements and national laws.

- Be sure to submit the application with correct level of match for the Category of Region, and provide full information included in the Financial Annexe.

Positive aspects

- All relevant information for developing a concrete ESF+ project budget to be submitted with the Full Application for a concrete Call of Proposals are written in the Guidelines for Applicants published with the Call for Proposals.

- ESF programmes have relatively professional and helpful contact points and guidance during the implementation and reporting phase, although it vary from country to country, since the contact points often have very strict audit themselves.

- EC is continuing with simplification reforms at all levels, paying attention to ESF+ specificities, and improving information and guidance for (new, small) beneficiaries.

- ESF+ aims at involving all stakeholders (incl. NGOs, CSOs, municipalities) throughout the programme cycle and it is strengthening the partnership and consultation between public bodies, beneficiaries, experts and civil society actors involved in ESF+.

- There is increase in the use of simplification options, and particularly the use of SCOs that have proved to be effective for ESF interventions and beneficiaries.

Negative Aspects

- Still very complex application and implementation procedure and especially project administration. Administrative burdens continue to be considered an important challenge for ESF beneficiaries. The uptake of the simplification options is too slow, gold plating and bureaucratic rigidities are adding regulative complexities, and there is still a lack of understanding of the new rules. In some cases simplification procedures seem to have led to even more reporting requirements.

- Social innovation is considered an important challenge for the new programming period. However, the implementation of social innovation projects often clash with rules and administrative systems that were designed for traditional vocational training actions.

- Frequent payment delays - Be sure to have a sufficient financial capacity together with the partners, both for pre-financing project implementation and co-financing (matching). ESF operates by calendar years, with 4 set claim periods ending in March, June, September and December. ESF Project claims must be submitted to the ESF Managing Authority within 25 working days of the end of each claim period. Each claim will then be subject to range of checks by the ESF Managing Authority before payment can be issued, which can last from 1 to several months – you must therefore ensure you have sufficient cash flow to manage the project.

- Bear in mind that retention (normally 10%) is held back at the end of every European Structural Investment Funds Project whilst the final claim and final verifications are carried out. Ensure enough financial resources to finish the project implementation since the final verification can last several months after the project ends.

- The intervention rate is different for each Category of Region and the ESF Project costs need to take this into account when calculating and confirming the levels of match-funding you need to provide. For example: More Developed Regions have a maximum intervention rate of 50% ESF funding; Transition Regions have a maximum intervention rate of 60% ESF funding; Less Developed Regions have a maximum intervention rate of 80% ESF funding.

- There should be more effort to support ESF beneficiaries at the EU level since the national managing authorities in some countries tend to be inefficient.

DOs and DON'Ts

DOs

01.

Clearly define a specific problem to be addressed.

02.

Provide updated and detailed data (statistics, data) for the “context” section.

03.

Clearly identify your target group and ways to reach it.

04.

Show the project impact using realistic indicators.

05.

Deliver practical outputs useful for the Justice operators/stakeholders.

DON'Ts

01.

Limit the partnership to the minimum eligibility requirements.

02.

Include partners without clear roles.

03.

Foresee too many deliverables.

04.

Include too many project meetings.

05.

Include a general/vague dissemination strategy or describe the benefits for the target groups in a general way